Another week has passed and time for another Trading 212 portfolio update.

After a first few weeks of keeping my returns in the green, my portfolio has plunged into the red.

I’m not really concerned by this, as only just started my investment adventures and slight drops in returns will (hopefully) not be significant in 10-15 years.

Also, with stock prices dropping it gives a great opportunity to drip feed my investment portfolio with some bargains.

Onto my pies….

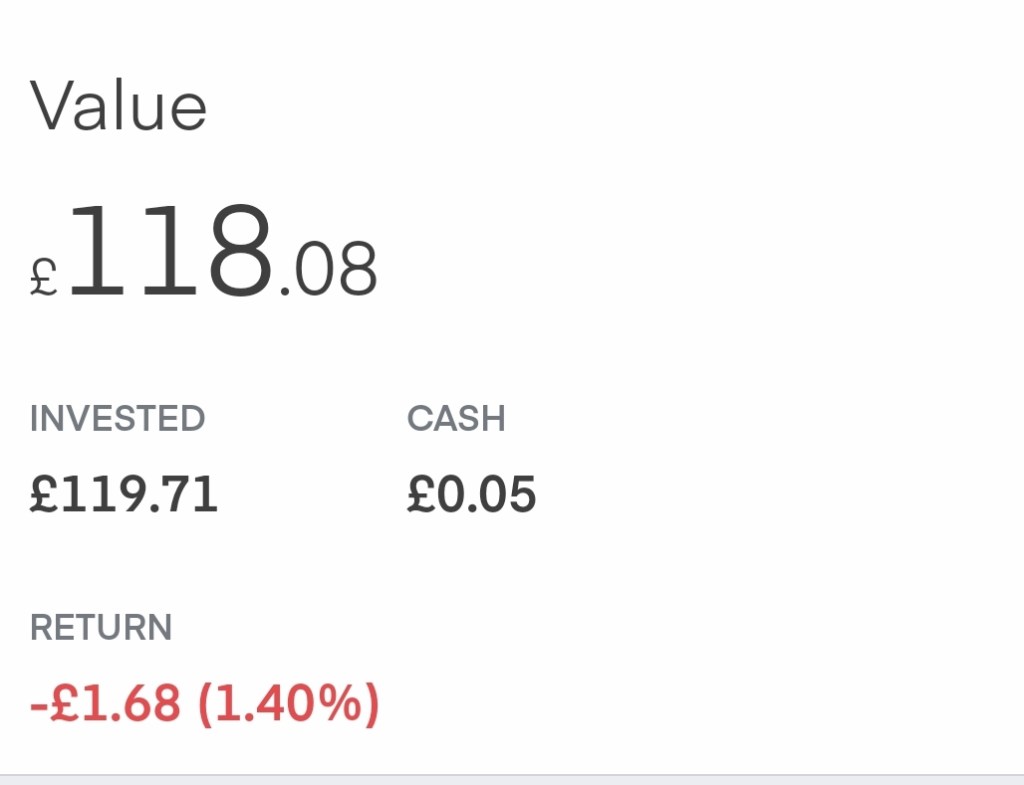

DIVIDEND PIE

As I did week before I’ve not been putting as much into this pot as would have liked.

The regular automated investment of £15 per week has been completed but I did not put in the manual deposits I had planned.

This was due to me concentrating on putting more payments into my new Starling saving Spaces – which have replaced my Plum saving pots.

Hopefully next week I’ll be able to fund this pie more.

I’m not too concerned about the drop in returns. This pie is for passive income and when dividends start dripping in I’ll be reinvesting it straight back into the pie.

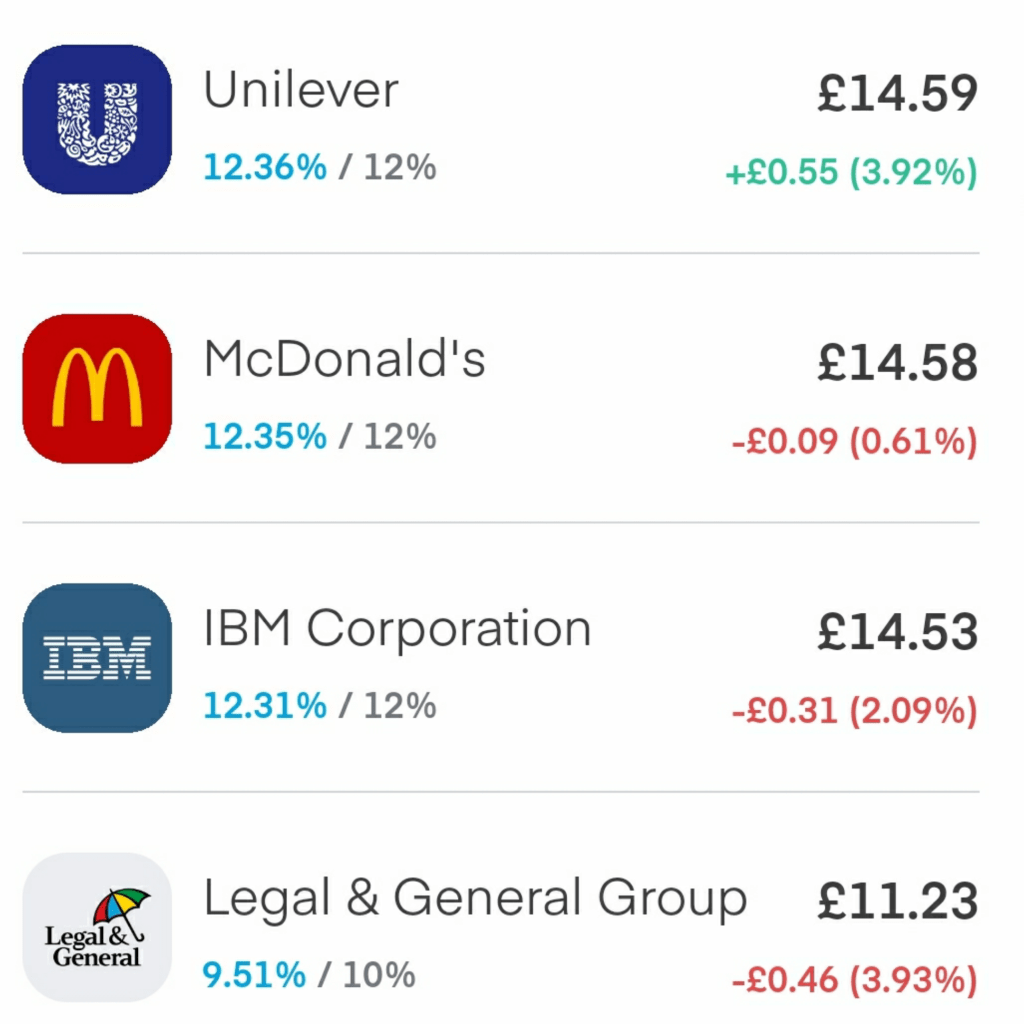

KISS PIE

It was bit of a bloodbath last week for my KISS (Keep It Simple Stupid) Pie, with only Amazon and Apple being in the positive.

Again not concerned. I believe these companies will bounce back and hopefully over the next few months and years, the graphs should head back in the right direction.

FUTURE PLANS

So, decision has been made!

I’m moving the funds in my Plum Investment ISA to a Trading 212 ISA.

I’ll also have to sell the stocks in my Trading 212 basic account and move them across to the Trading 212 ISA account.

I’ll also take this opportunity to put some more companies I’ve had my eye on (Spotify, Greggs and Lloyds) into the relevant pies and start my new ETF pie.

Exciting times!

Until next time reader…