My investing (mis)adventures started back January 2020.

As an historically terrible saver, for some reason I started seeing ads on my Facebook for a company called Plum who offered a service where you could have a savings account with them.

Whilst they didn’t offer interest on the account, what intrigued me was that by some financial wizardry they were able to calculate how much money you could save, without impacting you too much, and they would transfer from your account said amount on a weekly basis and stick it in the savings account for you.

All was great to start! They were taking about £20 a week and I wasn’t really noticing the deductions from my bank and was finally managing to save some money. I’d managed to save a couple of hundred quid and all was gravy!

Then I got a notification from Plum in February 2020 about their Investment ISA account.

I’d already in the previous months been watching YouTube videos about ‘Financial Freedom‘ and investing – which in hindsight was probably why I was seeing ads for Plum on my Facebook.

So I signed up for the Investment ISA account and picked some categories to invest in:

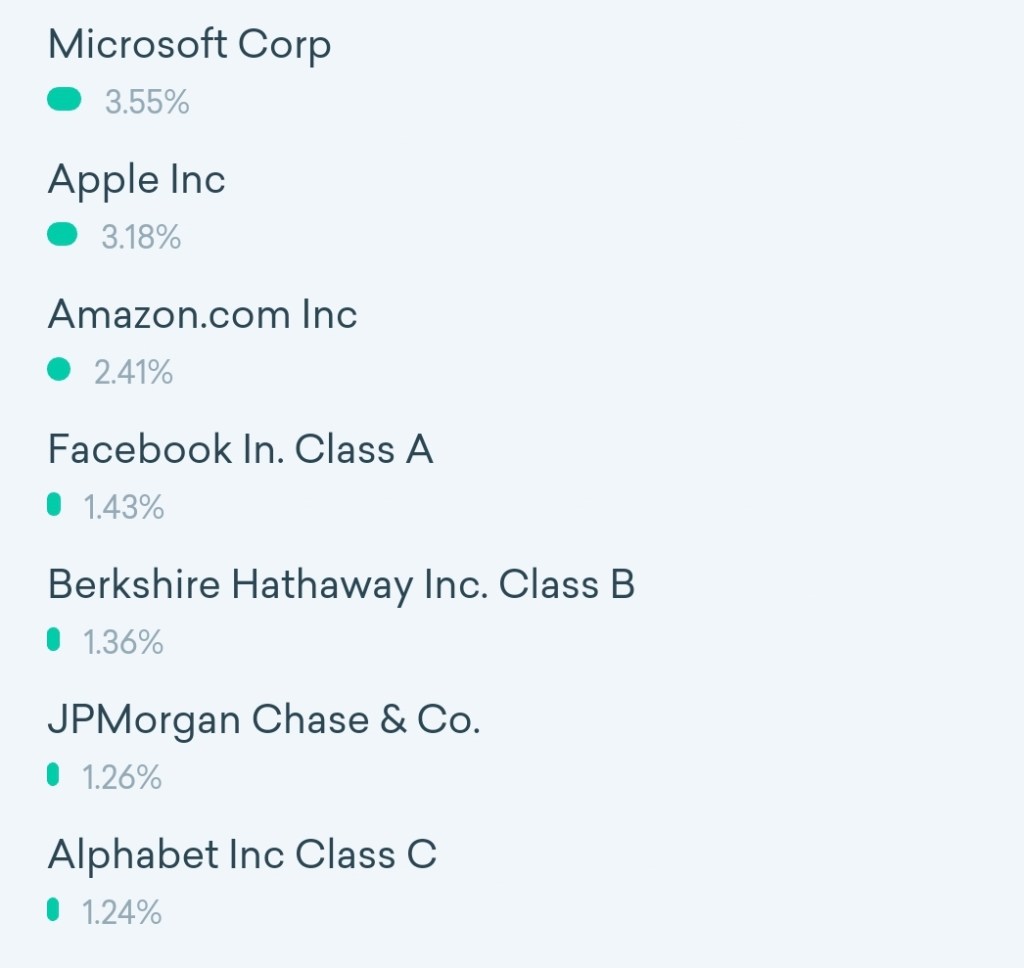

👨💻 Tech Giants – this provided the opportunity to invest in some global tech giants including Microsoft, Facebook, Apple and Google.

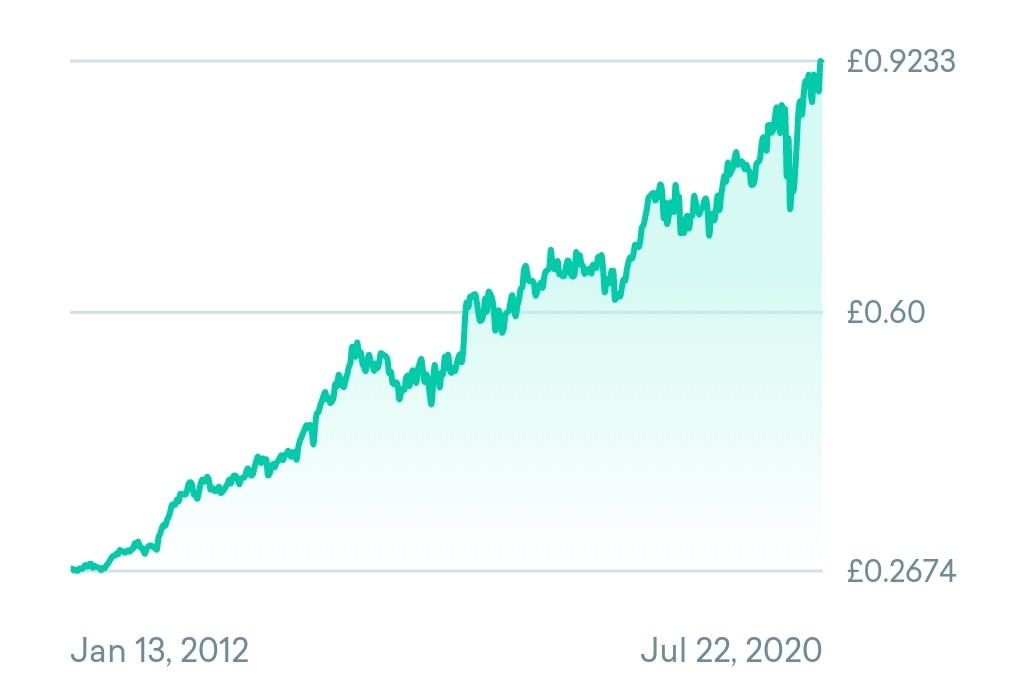

Since the funds start of December 2012 it had performed quite well, and as a bit of a geek, who loved many of these companies, this was a no-brainer for me.

🇺🇸 American Dream – this gave me the opportunity to invest in most of the biggest companies in the US. Known to many as the S&P 500.

Like the Tech Giant fund this had performed quite well, with a 5 year historic return of 14.8%.

🌍 Rising Stars – this fund allowed me to invest in the growth of ‘new’ giants in Asia and Africa.

I picked this, despite the high risk (6 out of 7) because I wanted to diversify globally.

Despite being a relatively new fund, as with the first two funds, it has also performed quite well 👍

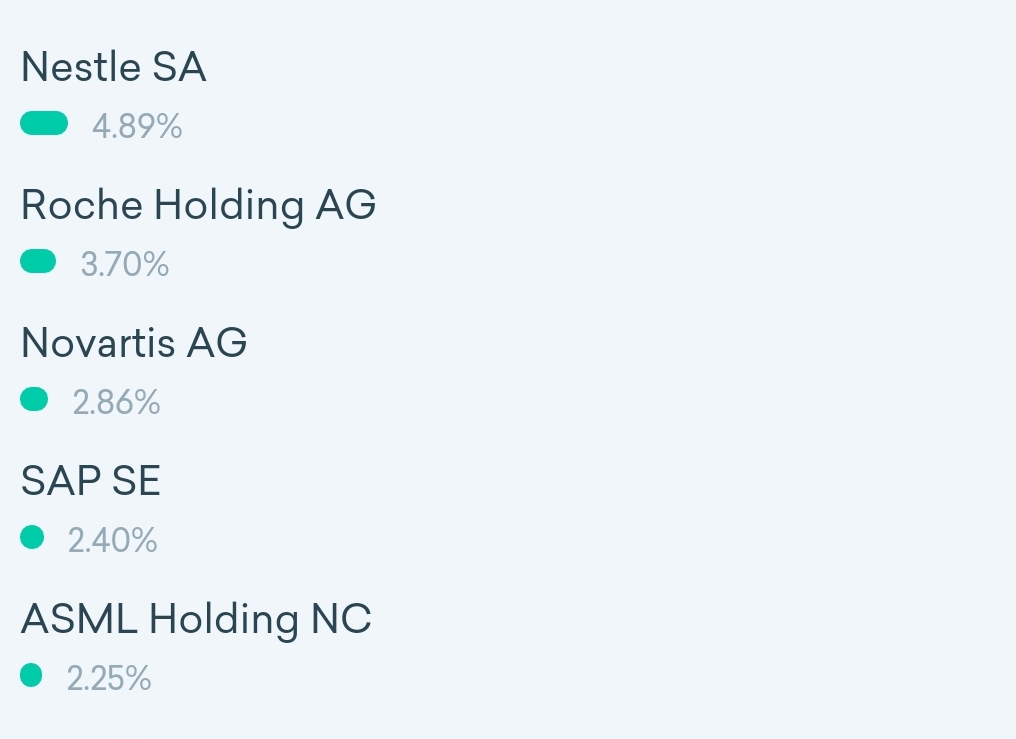

🏥 The Medic – this fund houses some of the largest healthcare, pharmaceuticals and biotechnology companies in the world.

Again, according to Plum’s risk scale this is one of the riskier funds (6 of 7) but everyone needs medicine, right? Especially in the current climate.

Despite the risk, this fund like all the others as performed well since it started.

Plum also offers a number of funds, I chose not to pick including:

🇬🇧 – Best of British – Shares of the 100 largest public companies in the UK, also known as the FTSE 100

♻️ Clean & Green – this fund is made up of companies who have been selected for their social responsibility.

🇪🇺 European Essentials – fund offers shares of large and mid-sized companies in developed markets in Europe, excluding the UK.

In hindsight, it probably would have been wise to have also invested in the Best of British and European Essentials for full global diversification.

Now though I have caught the investing bug, and having set up a Trading 212 account and starting to invest in individual companies I’m starting to think if it’s wise to keep my Plum ISA account going. Maybe it’s time to switch my Plum ISA to the Trading 212 ISA account.

I could set up equally well performing ETFs on Trading 212 to get the diversification I want.

Also, another thing that is swaying me to binning off Plum is the fees. Currently they are charging me £3 a month for the pleasure of using their platform and from what I understand Trading 212 do not charge a fee for their ISA account.

Will probably leave it a few months whilst I work out how to switch my ISA.

Also, if I do set up a Trading 212 ISA account I’ll have to sell off my current portfolio in the basic account and buy them back in the ISA account.

If anyone has any experience of switching their ISA from Plum to Trading 212, please leave your experience in the comments below. Was it an absolute ball ache or was it quite smooth?

Whilst I decide what I’m doing with my Plum account I’ll post monthly updates on how my Plum funds are doing- I’ll post the first one in a few days.

For more info on investing with Plum visit https://withplum.com/investments/.

For more info on Trading 212 visit https://www.trading212.com/.

Do you want to get a free stock share worth up to £100? Create a Trading 212 Invest account using this link www.trading212.com/invite/FzTvezO3 and we both get a free share!