So here it is my first Trading 212 portfolio update!

After 1 week of using the pies feature on Trading 212 I have managed to fill my portfolio with some Grade A stocks.

For my Dividend Investment Pie, I did intend to only pick a couple of stocks. I wanted to pick 3-4 stocks which paid out at particular times so I would receive dividend payouts every month of the year.

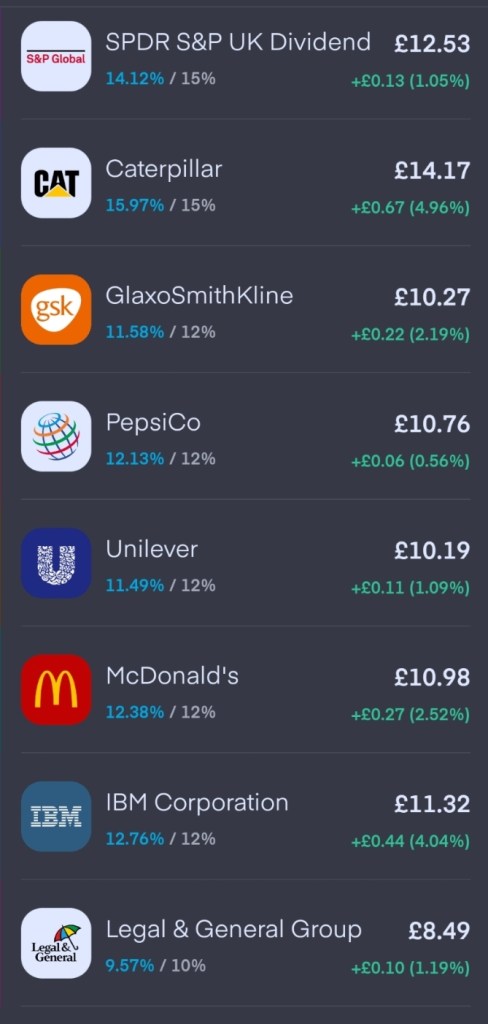

Somehow though I ended up with 8 stocks! Well 7 stocks and a dividend paying ETF.

I think I’ve got a well diversified portfolio covering most sectors.

Have I got all bases covered? Any sectors I’m missing you would recommend?

How Much Am I Investing?

So as mentioned in my first blog, I am not going to be able to invest 1,000s every week.

For my Dividend Pie I’m only going to be setting aside £15 per week.

However every couple of days I’m going to check my bank account and any spare £’s I transfer them to my investment account.

This seems to be working as even though only been investing over last couple of weeks, I already have £86 invested – so ahead of target!

By investing £15 per week and on an expected annual return of 7.78% I’m projected to get a return of £24.8k. I’ve set it for 16 years so will have a nice pot when I’m 60.

With the extra amounts I am putting on top of the regular automated investments I should reach this target a lot sooner!!!

A week after setting up the Dividend Pie I decided I wanted to set another one up!

For this one, called KISS (Keep It Simple Stupid) – with some of the big heavy hitter growth stock companies – Apple, Walt Disney, Google and Microsoft.

I’m not going to lie I did go a bit over board and some of the stocks I’m not quite sure of – especially Bank of America and Walt Disney!

For this Pie I will be investing £50 per month – again I will be checking my bank regularly and any spare £’s I’ll invest in this Pie too.

I’ve not complete the first £50 automated investment and I’ve already got £23 invested in the Pie.

These amounts may not sound a lot to most investors/readers but as explained in previous post I am a terrible saver and investing in mostly companies I love is making saving ‘fun’.

Based on investing £50 a month and a expected return 24.15% I’m looking to get a return of £88k when I’m 59!!

Again with the extra amounts putting in each week Im expecting to reach this target before then.

However, not 100% sure why Trading 212 is telling me I’m BEHIND my target – all most definitely have set something up wrong!

This is my first month of using Trading 212 and the graphs are going the right way – I’m in the green at least albeit only a small % return. Still think I’ll end up with a better return than if I left my money in the bank!

Anyway I am rambled on enough….I promise future updates won’t be this long. This has been more of an introduction to the portfolio.

If you have any recommendations on stocks please leave them in the comments below.

As well as reading about my investment adventures here, you can also follow me on Instagram or Twitter.

Do you want to get a free stock share worth up to £100?

Create a Trading 212 Invest account using this link http://www.trading212.com/invite/FzTvezO3 and we both get a free share!